This chart shows the latest statistics on organic traffic to OnlyFans and Fansly from the U.S. We analyzed data from Google’s search engine to illustrate how the visitation patterns for these platforms have changed over recent years.

Since the U.S. remains the largest market for paid content consumption on OnlyFans and Fansly, the chart provides a clear view of the popularity and evolving interest in these sites among the American audience.

Note: If the chart doesn’t load, try enabling a VPN — Looker Studio may be blocked in some countries.

OnlyFans Traffic Decline in the U.S.: 2025 Statistics

In 2025, OnlyFans began to rapidly lose organic traffic from the U.S. In August 2024, the site attracted about 40 million daily visitors from search alone, but by March 2025, that number had dropped to 24 million, and by May it fell further to 11 million per day.

At the same time, Google significantly reduced the number of keywords for which the domain onlyfans.com appeared in search results — from 960,000 in 2024 to 82,000 in 2025.

Although Google remains the platform’s main traffic source, this trend suggests either a decline in interest in the site or that users are visiting less frequently and spending less time on OnlyFans.

Possible Reasons for the Decline in Organic Traffic

- Google Updates: Over the past six months, algorithms have become stricter with sites hosting sensitive or monetizable content (YMYL), including adult platforms.

- Changing User Habits: More users are accessing the platform via Telegram, Instagram, or direct links, bypassing search engines.

- Market Saturation: The audience may have plateaued — most are already familiar with the platform and no longer search for it on Google like before.

- Political and Economic Instability in the U.S.: In 2025, censorship around the adult industry increased. Payment providers, ad networks, and even social media platforms have become more cautious with adult content. Amid inflation, elections, and protests, audience behavior has become less predictable — users are saving money, spending less, and subscribing less frequently to paid platforms. This impacts organic traffic as search volumes drop and consumption patterns shift.

Additionally, internal changes within the platform itself should be considered. Over the past year, OnlyFans hasn’t introduced major updates that could sustain user interest or drive growth. Users aren’t seeing new features, recommendation algorithms remain opaque, and content has become somewhat repetitive. This impacts behavioral factors — people visit less frequently, spend less time on the site, and ultimately this is reflected in organic traffic.

There are also increasing rumors about a possible sale of the platform. If leadership or strategy changes, it could affect both the technical side and marketing efforts — including the recovery of organic traffic. However, these are still just speculations, and the market is responding cautiously.

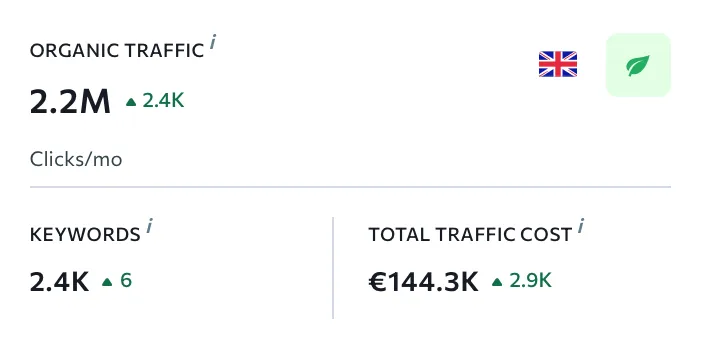

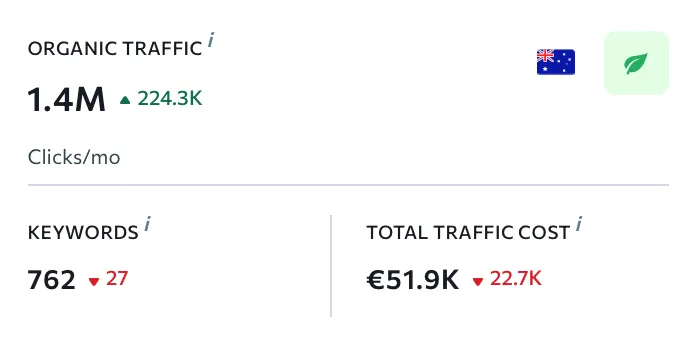

Comparison with Other Countries

While traffic from the U.S. is declining, organic traffic from the UK and Australia remains stable. This may indicate a regional shift in focus for the platform — OnlyFans continues to hold a strong position in these countries despite the downturn in the American market.

Fansly Organic Traffic Growth According to Google Data

At the same time, Fansly shows the opposite trend. The platform has been steadily increasing its organic traffic from the U.S.: in May 2024, the site received about 110,000 daily visitors from search, growing to 410,000 by May 2025.

Fansly is gradually strengthening its position as an alternative, reaching peak levels in organic visibility and audience interest.

Importantly, Fansly’s growth is happening without large-scale advertising campaigns. The platform is expanding organically—fueled by genuine interest, social media shares, and community referrals from Reddit, Facebook, Instagram, and X (Twitter).

Additionally, Fansly’s interface and moderation policies are seen as more creator-friendly. Models note that the platform delivers organic traffic and offers greater freedom in promotion and accessible analytics. All these factors influence user behavior and contribute to the platform’s positive growth trend.

Conclusion

Organic activity around OnlyFans and Fansly in the U.S. shows a clear shift in dynamics. While OnlyFans is losing search traffic and visibility, Fansly is strengthening its position and reaching record levels.

If this trend continues, Fansly could firmly establish itself as a key competitor in the U.S. paid subscription market in the coming months. For models and agencies, this is a signal to closely monitor traffic sources and diversify their presence across both platforms.

Traffic for OnlyFans and Fansly can be purchased on the Traffic Board — a platform featuring trusted providers and services for promotion.

I have been working in advertising and digital marketing since 2015. I started with e-commerce affiliate programs and later moved into the Dating vertical, where I gained extensive experience in traffic acquisition and monetization.

For the past four years, I have specialized in the OnlyFans niche: testing traffic sources, analyzing audience behavior across different social platforms, and collaborating with creators to help them build effective funnels and increase their revenue.

I also run my own Telegram channel where I share practical case studies, growth strategies, and performance insights.